In an effort to provide Ghanaians with digital access to life insurance, Bethniel Fintech, a startup with the goal of creating platforms that assist Africans in learning, doing business, and developing financially, has partnered with Sanlam Life Insurance Ghana, a division of one of the biggest insurance companies in Africa (Sanlam Group).

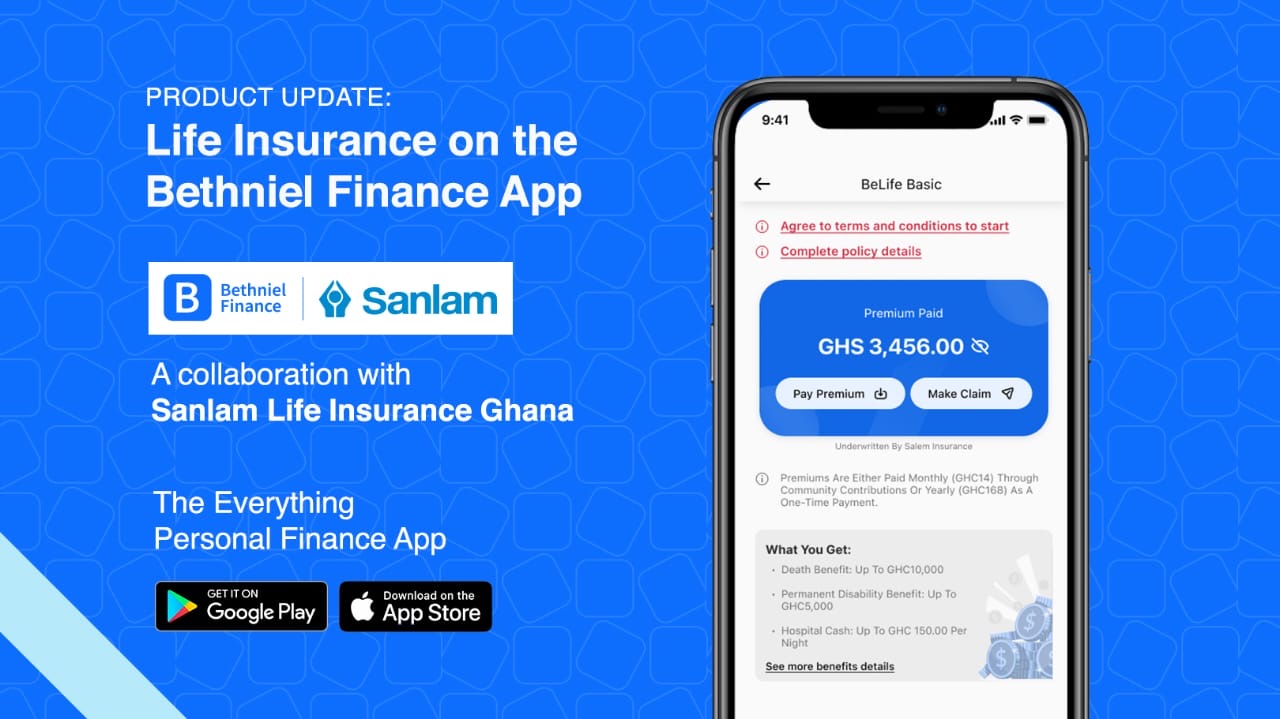

The partnership aims to provide life insurance to Ghanaians via the Bethniel Fintech app, Bethniel Finance, under the code name “BethLife Basic Insurance.”

In general, the Bethniel Finance App aims to provide Ghanaians with one location to access financial services, better money management education, and financial literacy.

The lack of knowledge about life insurance among Ghanaians is the reason for the misconceptions held by many of them. Furthermore, seven out of ten Ghanaians do not possess any type of life insurance, which forces them to borrow money or deplete their savings in the event of unanticipated events or uncertainties in life.

Ghanaians can now affordably and conveniently obtain life insurance through BethLife Basic, which will help them through unexpected and difficult times like the death of a loved one, a sickness that necessitates hospital stays, and lifelong injuries sustained at work.

This insurance policy offers the following benefits: ● A death benefit of up to GHC $10,000. This means that a maximum of GHC5,000 will be due when you (primary life) or the additional life pass away tragically.

A GHC5,000 permanent disability benefit. In the event that an accident or disease renders you permanently disabled, you will be entitled to this.

For a maximum of ten hospital stays, a GHC150 per night hospital cash benefit is provided. When you have to stay overnight at the hospital due to illness, this is payable.

The price of BethLife’s Basic Insurance

You may choose to pay a monthly (GHC14) or annual (GHC168) insurance premium in order to receive the benefits of this product. Because of the two partners’ cooperation, the cost of the insurance has been significantly reduced, making it very affordable for the typical Ghanaian. In essence, by paying GHC14 monthly or GHC168 annually, you can obtain a total coverage of up to GHC16,500 with BethLife Basic Insurance.Next Steps

To update Bethniel Finance, if you already have it, is all that’s required.

Get the Bethniel Finance App right away to get started on your insurance journey if you don’t already have it.