In Sub-Saharan Africa, cryptocurrency use is still a controversial topic. This occurs as a result of the absence of restrictions for digital currency.

Africa also happens to be the smallest region with the fastest developing cryptocurrency marketplaces. The intermittent adoption of digital currencies throughout the continent is to blame for this. Kenya, Nigeria, and South Africa, for instance, account for a sizable portion of all cryptocurrency transactions in the region’s 46 Sub-Saharan African nations.

Along with the irregular usage of cryptocurrencies, African governments also share a common concern over the use of a currency with little or no restrictions. An understandable anxiety considering the most recent failure of the third-largest cryptocurrency exchange in the world, FTX, and the ensuing decline in the value of Bitcoin, Ethereum, and other significant crypto assets.

The use of cryptocurrencies is still a major source of disagreement in many markets in the region as a result. The recent FTX crisis has reignited the debate about government regulation of cryptocurrencies, and people are now less inclined to switch from their local currency to a digital one.

However, this discussion will probably have minimal impact in Africa, at least shortly, given that regional authorities just have a general skepticism of blockchain technology. The conflict of interest that occurred in Nigeria during the #endsars period was proof of this.

The Nigerian government banned the usage of cryptocurrencies during the #endsars campaign, despite the people’s vain attempts to overturn this decision. If this is any indicator, it demonstrates that the people of Africa are prepared to embrace cryptocurrency use and are willing to face the risk, which is similar to the risk inherent in the stock market. Governments, however, are not.

“Policymakers are worried that cryptocurrencies can be used to transfer funds illegally out of the region and to circumvent local rules to prevent capital outflows. Widespread use of crypto could also undermine the effectiveness of monetary policy, creating risks for financial and macroeconomic stability,” according to a report by the International Monetary Fund.

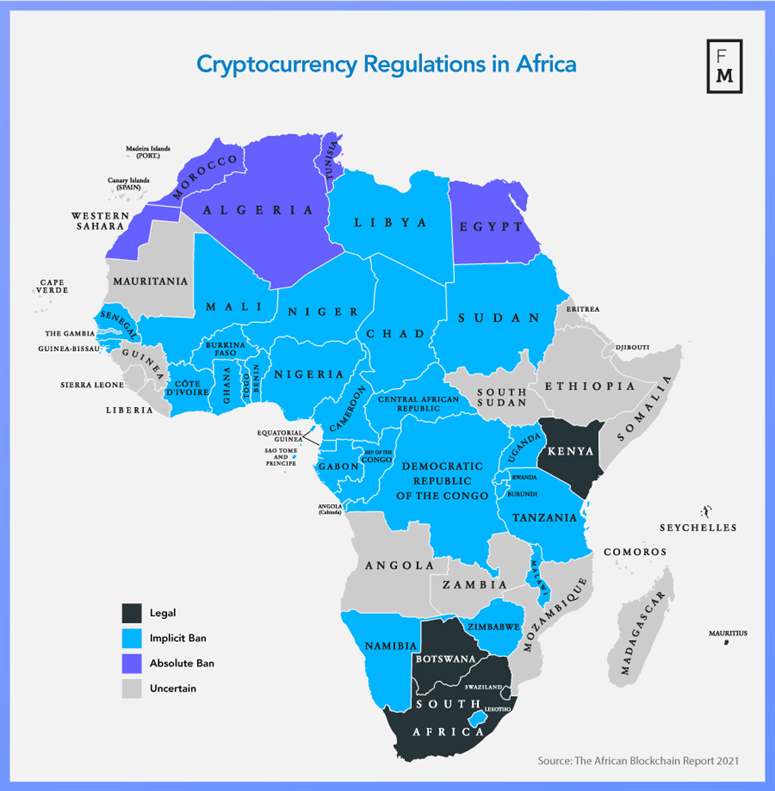

The IMF also reported that six governments have outright outlawed cryptocurrencies, and two-thirds of Sub-Saharan African nations have enacted some type of cryptocurrency restrictions in the same report titled the October 2022 Regional Economic Outlook for sub-Saharan Africa.

The IMF’s indirect ban part includes nations that have certain limitations on the use of cryptocurrencies, whilst its explicit ban portion includes nations that have outright bans. These six nations—Cameroon, Ethiopia, Lesotho, Sierra Leone, Tanzania, and the Republic of Congo—have all made it clear that they do not allow the usage of cryptocurrencies.